Introduction – PC Training Gains BCS Accreditation In a competitive training market, learners are increasingly selective. They want reassurance that their time, money, and effort...

Charting Your Course in Bookkeeping

Starting a bookkeeping career is an accessible and rewarding journey, and you often do not need a university degree to get going. The path is built on practical skills and professional recognition, which become your proof of competence in the finance industry. Unlike some legally protected professions, bookkeeping is all about showing you can do the job well.

But do not mistake that for meaning qualifications are optional. Think of it like this: anyone can kick a football around a park, but to play for a team, you need proper training and a solid grasp of the rules. Professional bookkeeping qualifications do the same thing—they tell employers you have the discipline, knowledge, and ethical grounding to manage a company’s finances accurately.

The Real Value of Your First Qualification

Your first qualification is your foot in the door. It proves you understand the core principles, from double-entry bookkeeping to preparing a trial balance. More importantly, it shows you can be trusted with sensitive financial data and are serious about upholding professional standards.

Many aspiring bookkeepers start their journey with flexible learning options that fit around their current jobs. Exploring methods like asynchronous e-learning is a great way to gain qualifications without putting your life on hold.

Stepping into the UK Job Market

Imagine stepping into the UK’s bookkeeping job market. You will find that many entry-level roles are surprisingly accessible, often requiring just a secondary school education or equivalent, along with good numeracy and IT skills. This makes it a great option for recent school leavers and career changers alike.

However, to truly stand out from the crowd, a recognised certificate is a game-changer. This guide will walk you through the specific training and courses you will need, from core bookkeeping and VAT to more advanced skills in payroll, final accounts, and even data analysis. Building this skill set is your key to success.

Read also: How Bookkeeping Training Can Launch Your Career in Finance.

Choosing Your Core Professional Qualification

Once you have decided to become a bookkeeper, the first big question is: which professional body should you qualify with? Think of it like choosing the right tools for a job; the best one depends entirely on what you want to build. In the UK, the most respected qualifications come from three main organisations: the Association of Accounting Technicians (AAT), the Institute of Certified Bookkeepers (ICB), and the International Association of Book-keepers (IAB).

Each of these bodies offers a different path, shaped for distinct career goals. Making a smart choice here means your time, money, and effort go into a qualification that opens the right doors for your future.

AAT: The All-Rounder’s Pathway

The AAT is often seen as the comprehensive, catch-all option. Its qualifications build a broad and solid foundation in accounting that goes well beyond pure bookkeeping. This makes it a fantastic choice if you can see yourself moving into wider finance roles down the line, perhaps as an Accounts Assistant or even a chartered accountant.

An AAT qualification tells employers that you get the bigger picture—you understand how all the financial pieces of a business fit together. Its structured levels let you start with the basics and steadily work your way up to complex skills like preparing final accounts. It is a hugely popular and recognised route, especially for those aiming for a corporate career.

ICB: The Specialist’s Choice

The ICB, on the other hand, is all about laser-focused specialism. Its qualifications are tailor-made for people who want to become true masters of the bookkeeping craft itself. If your dream is to run your own bookkeeping practice, work as a freelancer for multiple clients, or be the go-to expert within a company, the ICB is a perfect fit.

The curriculum zeroes in on the practical, day-to-day tasks a bookkeeper handles, including advanced payroll and VAT. The ICB places a strong emphasis on professional standards and practice management, giving you everything you need to operate independently with confidence.

Comparing the Top Professional Bodies

To help you figure out which path is right for you, let’s put these qualifications side-by-side. Seeing their core focus and likely career outcomes is the best way to match one to your own ambitions. For more guidance on this, our post on how to choose the right training course for your career goals is a great resource.

Comparing UK Professional Bookkeeping Qualifications

Here’s a side-by-side look at the primary qualifications from the UK’s leading professional bookkeeping bodies, highlighting their distinct focus and ideal career pathways.

| Qualification Body | Key Focus | Best Suited For | Core Skills Covered |

|---|---|---|---|

| AAT | Broad accounting and finance principles. | Aspiring accountants, corporate finance roles, Accounts Assistants. | Double-entry bookkeeping, final accounts, costing, business tax. |

| ICB | Specialised, practical bookkeeping and practice management. | Freelance bookkeepers, business owners, bookkeeping specialists. | Day-to-day bookkeeping, payroll management, self-assessment tax. |

| IAB | Global bookkeeping and business skills with a modern focus. | Entrepreneurs and professionals in SMEs seeking global recognition. | Digital bookkeeping, VAT, computerised accounting, business law. |

As the table shows, there’s a clear split: AAT is your ticket to a broad corporate path, ICB is for building a specialised practice, and IAB offers a flexible, business-focused approach. All three are respected, but they definitely open different doors.

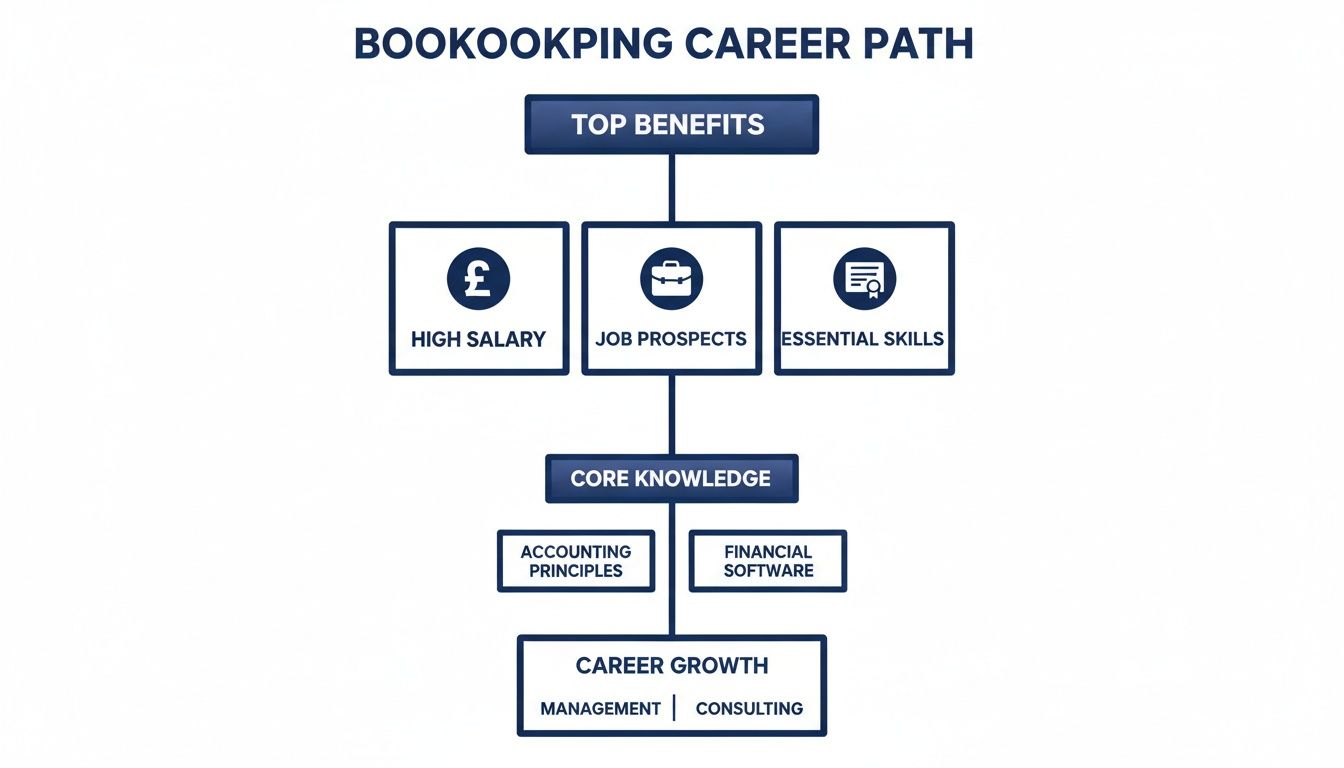

This career path breakdown illustrates how these foundational skills fit into the bigger picture.

As you can see, getting the right skills through qualifications directly translates to better job prospects and opens the door to a much higher salary potential.

Expanding into Analytical Roles

While traditional bookkeeping qualifications are your starting block, the world of finance is changing. Skills in business and data analysis are becoming more and more valuable. As a bookkeeper, you are perfectly placed to step into roles like Business Analyst or Data Analyst, where you are not just recording financial data, but interpreting it.

By learning to analyse the data you manage, you transform from a record-keeper into a strategic adviser. This is the key to future-proofing your career and adding significant value to any organisation.

These roles demand a different skillset, but they build directly on your core bookkeeping knowledge. Learning to use business intelligence tools or mastering data query languages can take your career to a whole new level. With analytical abilities, you can spot trends, create forecasts, and provide the kind of insights that guide major business decisions—making you an indispensable part of the team. Your journey starts with a core qualification, but it can lead to a dynamic career in financial analysis.

Mastering The Essential Software Tools

In the world of finance, theoretical knowledge and practical software skills are two sides of the same coin. Holding a professional qualification shows you understand the principles of bookkeeping, but being certified in key software proves you can apply them efficiently in a real-world business environment.

Think of it like this: knowing the Highway Code is essential for driving, but you cannot get on the road without passing your practical driving test. Software certifications for tools like Xero, QuickBooks, and Sage are your practical test—they are non-negotiable for any serious bookkeeper.

Why Software Certifications Matter to Employers

Employers do not just want to see that you understand double-entry bookkeeping; they want to know you can step in and manage their financial systems from day one. An official certification from a major software provider is a powerful signal of your competence and readiness.

It proves you can handle tasks with greater speed and accuracy, which cuts down the risk of costly human errors. More than that, it shows you are equipped to manage compliance with UK-specific regulations like Making Tax Digital (MTD), which legally requires businesses to keep digital records and submit VAT returns using compatible software.

A bookkeeper with a Xero Adviser or Sage Business Cloud certification can add immediate value. They move beyond simple data entry, becoming a strategic asset who can streamline processes, improve reporting, and provide actionable financial insights.

These credentials are clear evidence of your commitment to professional development and your ability to work with the tools that modern businesses depend on every single day.

The Big Three Software Platforms

While there are plenty of accounting software packages out there, the vast majority of UK businesses use one of three main platforms. Gaining certification in these will make your CV far more attractive to a wider range of employers.

- Xero: Known for its user-friendly interface and strong cloud-based features, Xero is incredibly popular with small to medium-sized enterprises (SMEs). A Xero Adviser certification shows you can manage everything from invoicing to bank reconciliation.

- QuickBooks: A global giant in accounting software, QuickBooks offers powerful tools for managing accounts, payroll, and tax. Its certification is highly valued by businesses of all sizes.

- Sage: A long-standing leader in the UK market, Sage provides robust and scalable solutions, particularly for established businesses. Sage 50 and Sage Business Cloud Accounting certifications are widely recognised.

As bookkeeping evolves, understanding modern accounting software is crucial. Dive deeper into how AI is transforming tools like QuickBooks and Xero to handle tasks automatically, exploring their key AI bookkeeping automation features.

Staying Ahead in a Changing Industry

The finance industry is constantly adapting, and your skills must adapt with it. There is a widening skills gap when it comes to digital systems, and with MTD for Income Tax set to arrive in April 2026, qualified bookkeepers with VAT and payroll skills are more essential than ever.

Gaining software qualifications is not just about learning to use a tool; it is about future-proofing your career. Professional training courses in Bookkeeping & VAT or Advanced Payroll will equip you with the practical skills needed to thrive.

Advancing Your Career with Specialist Skills

Getting your first bookkeeping qualification is a huge milestone, but it is also just the starting line. The real career acceleration—and the bigger paycheques—comes from layering specialist skills on top of that solid foundation. This is how you make the leap from a skilled bookkeeper to an indispensable senior finance professional.

By mastering more advanced disciplines through dedicated training, you open doors to new roles and seriously increase your value. It is about looking beyond the day-to-day transactions and stepping into high-demand areas that require strategic thinking.

From Core Skills to Senior Roles

Think of your initial qualification as learning the trade. You have got the tools and you know the rules. Now, it is time to become a master craftsperson. Specialising in specific areas is what separates the pros from the crowd and gets you noticed for promotions.

These specialisms are not just minor add-ons; they are distinct disciplines that businesses are crying out for. Getting skilled up can set you on a direct path to more senior and rewarding positions.

Here are the key training courses that really drive career growth:

- Bookkeeping & VAT: A course in this area takes you beyond simple VAT returns to expertly handle complex schemes, partial exemptions, and tricky cross-border transactions.

- Advanced Payroll: Mastering intricate payroll scenarios, including pensions, statutory pay, and benefits in kind to ensure bulletproof compliance.

- Accounts Assistant: This training prepares you for a broader role, covering everything from processing invoices to assisting with month-end reports, making you a versatile asset.

- Final Accounts Preparation: Learning to prepare financial statements for sole traders, partnerships, and limited companies—a vital skill for any business come year-end.

This kind of strategic upskilling is all about future-proofing your career. You evolve from someone who records financial history into a professional who helps shape a company’s financial future.

The Rise of the Analyst in Finance

The role of a finance professional is changing fast. Accuracy and compliance are still the bedrock, but businesses now expect more. They need people who can interpret the numbers, not just report them. This shift has created a massive demand for finance professionals with sharp analytical skills.

This is where training for roles like Business Analyst and Data Analyst comes in. These positions build directly on your bookkeeping expertise. You already understand the financial data; the next step is learning how to analyse it to spot trends, find opportunities, and solve business problems.

Adding analytical tools to your skillset makes you a powerful asset. For example:

- Business Analyst Courses: These teach you to bridge the gap between business needs and technological solutions, using data to drive process improvements.

- Data Analyst Training: Here you will learn to use tools like Power BI and SQL to turn raw financial data into clear, visual stories that guide decision-making.

By picking up these skills, you become the bridge between the finance department and the rest of the business, translating complex data into insights that everyone can understand and act on.

Your Pathway to Higher Earnings

Investing in these specialist qualifications for bookkeeping has a direct and immediate impact on your earning potential. The UK accountancy sector is full of opportunity, but advanced credentials are your ticket to the best roles and fastest progression.

For instance, Robert Half’s 2026 Salary Guide shows that finance business partners—a role many bookkeepers progress into—can earn £54,500 at the 50th percentile, rising to £66,250 at the top end. The guide also notes that certifications from bodies like AAT, ACCA, or CIMA give those salaries a significant boost.

The message is crystal clear: continuous professional development (CPD) is the engine for growth. By consistently updating and expanding your skills through targeted training courses, you ensure you remain relevant, valuable, and highly sought-after in a competitive job market. Your next qualification is not just a piece of paper; it is the next rung on your career ladder.

How to Market Your New Qualifications

Earning powerful new qualifications for bookkeeping is a massive achievement, but their real value is only unlocked when employers and clients know you have them. Effectively marketing your skills is the crucial next step to landing that dream role or winning new business. It is all about translating your certificate into tangible benefits that make you the standout candidate.

Think of it this way: a qualification is not just another line on your CV. It is solid proof that you can walk in and start solving a company’s problems from day one. Your job is to connect the dots for them.

Optimising Your CV for Success

Your CV is your first handshake with a potential employer, and it has to make an immediate impact. With many companies using Applicant Tracking Systems (ATS) to screen applications, your CV needs to be optimised to get past the software and into human hands.

- Dedicated Qualifications Section: Do not bury your new credentials. Create a specific section called “Professional Qualifications & Certifications” right at the top of your CV, just under your personal summary. List your most relevant qualifications first, like “AAT Level 3 Diploma in Accounting” or “Xero Adviser Certified.”

- Keyword Alignment: Weave the names of your qualifications and the specific skills you gained (think “VAT returns,” “advanced payroll,” or “final accounts preparation”) throughout your work experience descriptions. This is how you tell the ATS that you are a perfect match for the job description.

- Quantify Your Achievements: This is where you really stand out. Do not just list what you did; show the impact you made. Instead of saying “Managed accounts payable,” try something like, “Streamlined the accounts payable process using Xero, reducing invoice processing time by 15%.” Numbers grab attention.

Articulating Your Value in Cover Letters and Interviews

Your cover letter and interview are where you bring your qualifications to life. This is your chance to tell a compelling story about how your training makes you the perfect fit for the challenges they are facing.

Your goal is to connect your certification directly to a business’s needs. Explain how your skills in advanced payroll or data analysis will help them save money, improve efficiency, or make better strategic decisions.

For example, if an interviewer asks about your strengths, you could say: “My recent training in data analysis means I can do more than just record transactions. I can analyse sales data to identify key trends and present my findings in a clear dashboard, providing insights that can directly support business growth.”

This single sentence transforms your qualification from a piece of paper into a powerful, problem-solving tool.

Your Questions About Bookkeeping Qualifications Answered

Stepping into the world of professional training always brings up a few questions. To help you move forward with confidence, I have put together answers to the most common queries we hear about bookkeeping qualifications here in the UK. The goal is to give you direct, clear advice to resolve any lingering uncertainties you might have.

Can I Become a Bookkeeper in the UK Without Formal Qualifications?

Legally, yes. You can perform basic bookkeeping tasks without a formal certificate. But here is the reality: for any role that comes with real responsibility, a decent career path, and a competitive salary, employers see qualifications from bodies like AAT or ICB as non-negotiable.

Think of it as a quality guarantee. These certifications act as a trusted benchmark, proving your skills, dedication, and professional standards to potential clients and hiring managers alike.

How Long Does It Take to Get Qualified?

This really depends on the qualification level you choose and how quickly you want to study. A foundational certificate, like the AAT Level 2, can often be wrapped up in six to twelve months of part-time study.

A more advanced Level 3 qualification might take between twelve and eighteen months to finish. The great thing about modern training is its flexibility, which lets you learn at a speed that fits your life. On the other hand, software certifications for essential tools like Xero or Sage can be ticked off in just a few weeks.

Should I Choose AAT or ICB for My Qualification?

This is one of the most important decisions you will make, and it all comes down to your long-term career goals. Imagine you are choosing a path in a forest; both lead to great destinations, but they take you through different scenery.

- AAT: This is your best bet if you can see yourself moving into broader accounting roles, like an Accounts Assistant or eventually a Chartered Accountant. It gives you a wide-ranging foundation in all aspects of finance.

- ICB: This route is perfect for aspiring specialists. If your dream is to run your own successful bookkeeping business or become a go-to freelance expert, the ICB’s focused curriculum provides the exact practical skills you will need.

Do I Need to Be a Maths Genius to Be a Bookkeeper?

Absolutely not. This is a common myth that unfortunately holds a lot of talented people back. While you need to be comfortable and confident with numbers, the role is far more about logic, accuracy, and having an eagle eye for detail.

The job is not about complex calculus; it is about applying established rules correctly and methodically. Modern accounting software does all the heavy lifting—your crucial role is to ensure the data going in and the processes being followed are flawless.

Ready to gain the skills that employers are looking for? Professional Careers Training offers expert-led courses in bookkeeping, VAT, payroll, and data analysis to help you launch or advance your finance career. With flexible timetables, official software certifications, and dedicated recruitment support, we provide the practical training you need to succeed. Visit Professional Careers Training to explore our courses and take the next step.