Introduction – PC Training Gains BCS Accreditation In a competitive training market, learners are increasingly selective. They want reassurance that their time, money, and effort...

Your First Step into UK Accounting

Forget the old stereotype of a stuffy, quiet office. Modern accounting is a dynamic field right at the heart of business strategy. The demand for fresh talent has never been higher. Exciting roles are opening up across the entire country, not just in the capital.

This is not just a hunch; the numbers tell the story. Recent analysis reveals a massive 17% surge in accountancy hiring from commercial and industrial employers. This is the strongest rebound seen in over a decade.

While London vacancies are up a respectable 15%, the real action is happening elsewhere. The South West is leading the charge with a staggering 47% growth. This is followed closely by the West Midlands at 29% and Yorkshire & the Humber at 37%. You can dig into the full regional hiring trends report from Morgan McKinley to see the details.

This kind of growth creates a fantastic environment for anyone starting out or looking for a career change. Companies are actively searching for new people to fill roles that are absolutely critical to their success.

What a Modern Accounting Role Actually Involves

Today’s accountant is a tech-savvy advisor. Your day-to-day work is less about manually balancing ledgers. It is more about using powerful software to uncover insights that drive business decisions.

Here are a few key areas where demand is particularly high. These are the fields where practical courses and training can give you a significant advantage:

- Bookkeeping & VAT: Using cloud-based software like Xero or Sage to manage daily finances and keep businesses tax-compliant. This is a foundational skill for almost any entry-level role.

- Advanced Payroll: A vital function in any company. This involves managing complex payrolls, pensions, and statutory payments. Specialised training in this area is highly sought after.

- Accounts Assistant: Supporting the finance team with everything from processing invoices to helping prepare monthly financial reports. A role that requires a broad skill set.

- Final Accounts Preparation: Assisting with the crucial year-end process to produce statutory accounts for businesses. This is a key step towards more senior accounting positions.

- Business & Data Analyst: Using tools like Excel, SQL, and Power BI to analyse financial data and identify important trends. This is a rapidly growing area that combines finance with technology.

The role has fundamentally shifted. An accountant today is a strategic partner. They are moving from just recording what happened in the past to actively shaping a business’s future. It makes breaking into the field more exciting than ever before.

This guide is your roadmap. We will cover the essential qualifications like AAT and ACCA. But just as importantly, we will dive into the practical software skills and job-specific training that employers are desperate for right now. Whether you are a recent graduate or making a career pivot, we will show you how to turn your ambition into a rewarding job.

Choosing Your Pathway into the Profession

Deciding on the best way to get into accounting can feel like a huge decision. The good news is there is no single ‘right’ answer. The best route for you depends entirely on your current situation, your learning style, and what you want to achieve in the long run. You have several strong options. Each offers a different mix of academic theory and practical, on-the-job training.

The three main pathways are the traditional university degree, a hands-on apprenticeship, or diving straight into professional qualifications. Each has its own unique benefits. These range from the deep theoretical grounding of a degree to the immediate workplace immersion of an apprenticeship. Understanding these differences is the first step toward making a confident choice.

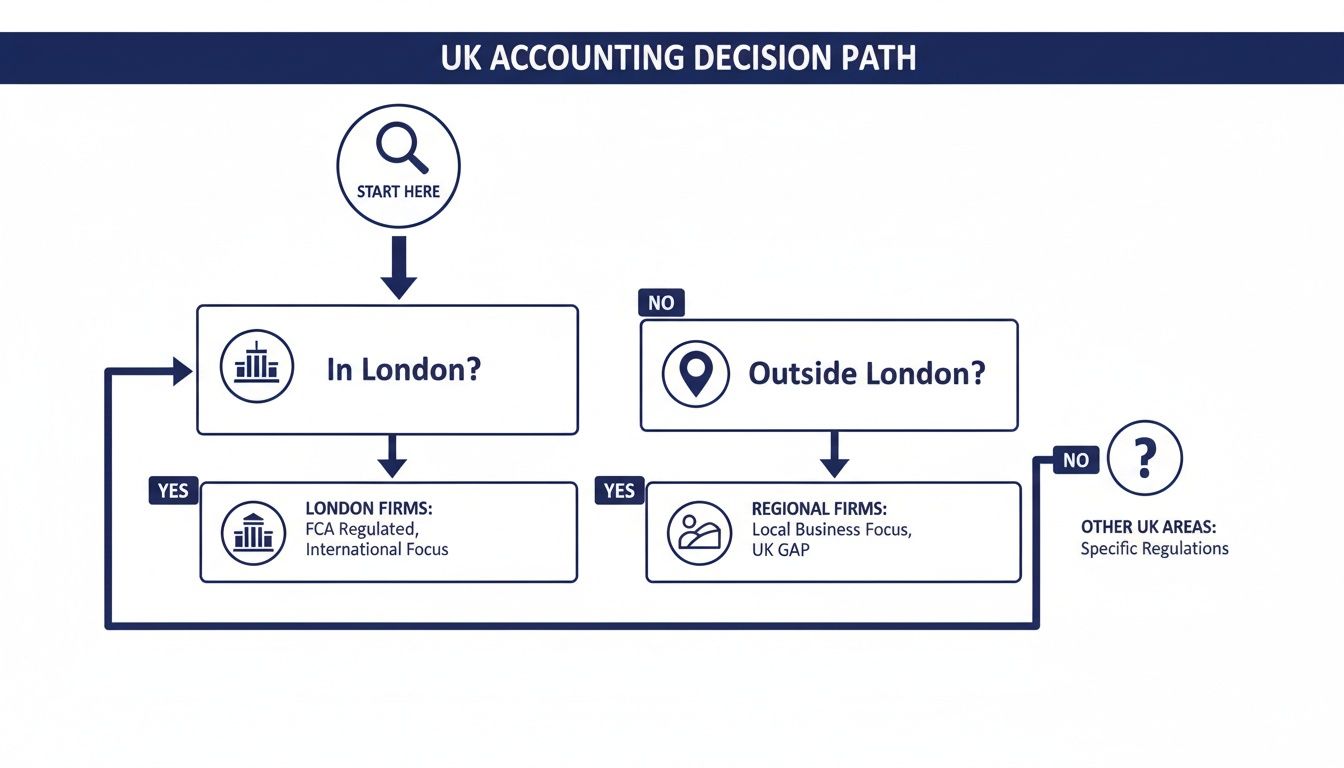

This decision tree helps to visualise the key things to consider when choosing your accounting pathway, whether you are based in London or elsewhere in the UK.

As the flowchart shows, your location and career ambitions can steer you toward the most suitable qualifications and training. This is true whether you are aiming for a corporate role or hoping to start your own practice.

The University Degree Route

A university degree in accounting and finance provides a fantastic theoretical foundation. Over three or four years, you will explore complex topics, develop critical thinking skills, and gain a qualification that is recognised globally. Many degrees also offer exemptions from certain professional exams later on, which is a big plus.

However, a degree is often just the beginning. Most graduates still need to complete professional qualifications like ACCA or CIMA while working to become fully chartered. This route is ideal for those who enjoy academic learning. It suits those who want a broad understanding of business and finance before they specialise.

The Apprenticeship Route

Apprenticeships offer a powerful alternative. They allow you to earn a wage while you learn from day one. This pathway combines practical, paid work experience with structured study towards a professional qualification, such as the AAT (Association of Accounting Technicians).

This is an excellent option if you are eager to get into the workplace and apply your knowledge immediately. Apprenticeships are highly valued by employers. This is because they produce candidates with proven, real-world skills. The duration can vary, but you will finish with a respected qualification and several years of relevant experience on your CV.

Choosing a vocational route like an apprenticeship or a direct AAT qualification can significantly accelerate your career. You gain practical, job-ready skills that employers are actively seeking. This often puts you ahead of graduates in terms of hands-on experience.

Direct Professional Qualifications and Courses

You do not necessarily need a degree or an apprenticeship to start. You can begin studying directly with a professional body. The AAT qualification is a brilliant starting point. It is widely respected as the industry standard for foundational accounting skills.

Beyond qualifications, focused training courses can equip you for specific roles very quickly. These courses concentrate on the practical tasks you will perform daily. They are ideal for career changers or anyone wanting to gain job-ready skills without a long-term commitment. Key training areas include:

- Bookkeeping & VAT

- Advanced Payroll

- Accounts Assistant duties

- Final Accounts preparation

- Business and Data Analysis

Completing these courses provides a direct pathway to relevant roles. You can then progress to chartered status with bodies like ACCA or CIMA, often with generous exemptions from AAT qualifications. This route is perfect for those who want a flexible, practical, and cost-effective way into the profession. You can learn more by exploring our detailed guide on how to become a chartered accountant in the UK.

Comparing Your Main Entry Routes into UK Accounting

Making the right choice is much easier when you can see the key differences side-by-side. Each pathway caters to different learning preferences and career timelines. Take a moment to consider which one aligns best with your personal and professional ambitions.

| Pathway | Best For | Typical Duration | Key Outcome |

|---|---|---|---|

| University Degree | Those who prefer academic study and want a strong theoretical base. | 3-4 Years (Full-Time) | A Bachelor’s degree, often with some professional exam exemptions. |

| Apprenticeship | Practical learners who want to earn while gaining hands-on work experience. | 2-4 Years | A professional qualification (e.g., AAT) plus valuable industry experience. |

| Professional Qualification | Career changers and those seeking a flexible, direct route into a specific role. | 18-24 Months (AAT) | A job-specific qualification that gets you into the workforce quickly. |

Ultimately, every path can lead to a successful and rewarding career in accounting. The key is to choose the one that best fits your learning style, financial situation, and how quickly you want to start making an impact in the workplace.

Building the Skills That Get You Hired

Qualifications might get your foot in the door for an interview. However, it is your practical, hands-on skills that will actually land you the job. When you are trying to get into accounting, building a modern toolkit shows employers you can add value from day one. It is about proving you are ready for the real-world challenges of a finance department.

First, we will cover the absolute non-negotiables—the software that powers pretty much every small and medium-sized business in the UK. Then, we will dig into the advanced skills that will set you apart. These will open up doors to more specialised, higher-paying roles. Training courses focused on these skills are your fastest route to becoming an attractive candidate.

Mastering the Core Accounting Software

For any entry-level role, whether it is Bookkeeper, Payroll Clerk or Accounts Assistant, you simply have to be proficient in cloud accounting software. These platforms are the digital bedrock of modern finance. They take care of tedious tasks and provide financial data in real time.

You should aim for deep confidence in the “big three”:

- Xero: A massive favourite among small businesses and their accountants. This is mainly because it is so user-friendly. Mastering its bank reconciliation, invoicing, and reporting features is a must.

- Sage: A true industry heavyweight. Sage offers a powerful suite of tools for everything from bookkeeping to payroll. Experience with Sage 50 is particularly valuable for many UK businesses.

- QuickBooks: Known for its solid reporting features and inventory management. QuickBooks is another incredibly popular choice, especially for businesses in commerce and industry.

Being able to walk into an interview and confidently say you can manage VAT returns in Xero or process supplier invoices in Sage makes you a much more attractive candidate right away.

A common mistake I see is people just listing software on a CV. Do not do that. Focus on what you can do with it. For example, “Used Xero to process and reconcile over 200 monthly transactions” is far more powerful than just “Proficient in Xero.”

The industry’s reliance on tech is only getting stronger. The UK Accountancy Sector Outlook Report found that a massive 75% of top firms are ploughing more money into cloud accounting and automation. You can read more about how firms are embracing technology on silverfin.com. This trend makes your software skills more critical than ever.

Developing Your Advanced Analytical Toolkit

Once you have got the fundamentals nailed down, it is time to build the skills that will truly make you stand out. This is where you shift from being a processor of information to an analyst who provides genuinely valuable insights. Training in these areas is crucial for roles like Business Analyst or Data Analyst.

Advanced data skills are not just for data analysts anymore. They are becoming essential for any ambitious accounting professional. And the good news is, the tools that get you there are more accessible than you might think.

Here are the key areas to focus on for career progression:

- Advanced Excel: Move beyond basic SUM functions. You need to learn PivotTables to summarise huge datasets, VLOOKUP or XLOOKUP to merge information from different sheets, and the basics of financial modelling to help forecast business performance. An Accounts Assistant, for example, could use a PivotTable to quickly analyse departmental spending and flag any budget variances.

- Power BI: This is Microsoft’s data visualisation tool, and it is a game-changer. It lets you create interactive dashboards that turn boring spreadsheets into clear, compelling stories. Imagine presenting your manager with a live dashboard showing sales trends instead of a static, printed report.

- SQL (Structured Query Language): Learning basic SQL allows you to pull financial data directly from databases. This is an incredibly powerful skill, especially in larger companies where data is everything. A Finance Analyst might use SQL to investigate payment discrepancies by examining the transaction database directly. This is a task that would be impossible with just a spreadsheet.

These skills show you have a proactive and analytical mindset. They prove you understand that modern accounting is about interpreting data, not just recording it. Investing your time in courses that cover bookkeeping, payroll, and final accounts alongside these analytical tools will give you a well-rounded profile that employers will be fighting over.

How to Gain Practical Experience That Stands Out

It is the classic career puzzle: how do you get a job without experience, and how do you get experience without a job? Breaking this cycle is the single most important hurdle to clear when you are getting into accounting. Theory is a great start. But employers want to see proof that you can handle the day-to-day realities of a finance role.

The goal is to build a portfolio of real achievements you can talk about in interviews. Just as importantly, you need to list them on your CV. This does not just mean a formal, paid role. There are plenty of ways to gain credible, professional experience that will make hiring managers sit up and take notice.

Look Beyond Traditional Internships

While internships and apprenticeships are fantastic routes, they can be fiercely competitive. Do not limit your search to just these formal programmes. Some of the most valuable experience is found in places you might not expect. These offer a chance to apply your skills directly and make a real impact.

Think outside the box with these proactive approaches:

- Volunteer for a charity: Small charities and non-profits often run on tight budgets. They would be incredibly grateful for skilled help. Offering to manage their bookkeeping, prepare their VAT returns, or run their payroll provides you with brilliant, real-world experience.

- Help a local small business: Pop into a local sole trader’s shop or a small family-run business. Many are so busy with day-to-day operations that their financial admin gets pushed to the bottom of the pile. You could offer to set them up on Xero or reconcile their bank accounts for a few hours a week.

- Take on small freelance projects: Platforms like Upwork or Fiverr are full of small, one-off bookkeeping or data entry jobs. Taking on these tasks helps you build a portfolio and shows initiative.

The key is to reframe what ‘experience’ really means. It is not just a nine-to-five paid job. Managing the quarterly bookkeeping for a community centre using Sage is a powerful, quantifiable achievement that absolutely belongs on your CV.

Finding and Securing These Opportunities

Landing these kinds of roles requires a proactive mindset. You will not see them advertised on major job boards. You need to get out there and create the opportunities for yourself. Start by building your professional network and making direct, polite approaches.

A great place to begin is LinkedIn. Connect with local business owners, charity trustees, or managers of community organisations. Send a brief, professional message. Explain that you are an aspiring accountant looking to gain practical experience. Outline the specific skills you can offer, like payroll or bank reconciliation.

This direct approach shows confidence and a genuine desire to contribute. Even if one person says no, another might know someone who needs exactly the kind of support you can provide. Each project you complete becomes another stepping stone. It builds both your credibility and your professional network. This kind of practical exposure is a core element of how our courses help students get job-ready and stand out in a crowded market.

Ultimately, your goal is to add lines to your CV that look like this:

- Accounts Assistant (Volunteer), Local Sports Club: Managed weekly takings, reconciled bank statements in QuickBooks, and prepared monthly income reports.

- Bookkeeper, Independent Cafe: Processed supplier invoices and employee expenses, contributing to the preparation of quarterly VAT returns.

This kind of specific, hands-on experience transforms you from a candidate with qualifications into a candidate with proven abilities. It shows you are serious about getting into accounting. It also gives you compelling stories to share in your next interview.

Crafting a CV and Nailing Your Interview

You have put in the work to build your skills and get some experience under your belt. Now it is time to tell a compelling story that grabs an employer’s attention. Your CV and interview performance are where you make your case. This is where you turn all that potential into a concrete job offer.

This is not just about listing what you have done. It is about proving what you can do for a business.

The first hurdle is often an automated screening system. So your CV needs to be optimised with the right keywords. For an Accounts Assistant role, that means explicitly mentioning terms like “bookkeeping,” “VAT returns,” “Xero,” and “Sage.” Think like a recruiter—what terms would they search for to find someone like you?

Building an Accounting CV That Gets Noticed

A generic, one-size-fits-all CV will not cut it. To stand out when you are just getting into accounting, you need to highlight specific, relevant achievements. Crucially, you should quantify them wherever possible. Numbers tell a powerful story and give solid proof of your capabilities.

Instead of saying you “helped with bookkeeping,” try reframing it like this:

- “Reconciled accounts for transactions totalling over £50,000 per month using Xero.”

- “Assisted in processing a fortnightly payroll for 75 employees, ensuring 100% accuracy.”

- “Created a new sales dashboard in Power BI, which helped identify a 10% increase in regional demand.”

This simple switch transforms your duties into tangible accomplishments. It shows you understand the impact of your work on the business. It is also a great idea to create a dedicated section for your software skills (e.g., Xero, Sage, Power BI, Advanced Excel). A hiring manager can then instantly see you have the tech sorted.

Your CV is your marketing document. Its sole purpose is to get you an interview. Make sure every line earns its place by demonstrating value, not just listing tasks.

In today’s market, your professional presence goes beyond a two-page document. You need to build a strong personal brand on LinkedIn to showcase your expertise and connect with potential employers. A polished, active profile that mirrors your CV shows consistency and real professionalism.

Preparing for Common Interview Questions

Once your CV has done its job and secured you an interview, the next challenge is to answer questions with confidence and clarity. For junior accounting roles, interviewers are testing three things. These are your technical grasp, your problem-solving abilities, and your genuine enthusiasm for the profession.

You can almost guarantee you will be asked things like:

- “Can you walk me through the process of a bank reconciliation?”

- “What do you understand about double-entry bookkeeping?”

- “How would you handle a situation where a supplier invoice does not match the purchase order?”

The secret is not just knowing the answer but structuring it well. This is where the STAR method is your best friend. It gives you a simple framework for telling a clear, impactful story.

- S – Situation: Briefly set the scene.

- T – Task: Explain what you needed to do.

- A – Action: Detail the specific steps you took.

- R – Result: Share the positive outcome of your actions.

For instance, if asked about handling a discrepancy, your STAR response might sound something like this: “At my volunteer role (Situation), I was tasked with processing supplier invoices (Task). I noticed a £200 discrepancy on an invoice, so I cross-referenced the purchase order, contacted the supplier to clarify the charge, and received a corrected invoice (Action). This saved the charity £200 and kept the accounts payable ledger accurate (Result).”

Advice for International Applicants

If you are applying from overseas, be ready to discuss your right to work in the UK clearly and confidently. It is often helpful to state your visa status directly on your CV (e.g., “Graduate Visa valid until [Date]”).

In the interview, show your commitment to building a career in the UK. Mentioning your knowledge of local regulations, like UK VAT or PAYE, demonstrates that you understand the business environment here. Highlighting how your skills, like certified payroll training, can boost your CV is a brilliant way to show you are ready to contribute from day one.

Your Next Steps Towards a Successful Accounting Career

Alright, you have done the hard work. You have mapped out the different pathways, pinpointed the tech skills that matter, and figured out how to get that all-important hands-on experience. The final piece of the puzzle is taking that confident next step towards landing your first role.

So, how do you bridge the gap between learning and earning? The most direct route is through focused, practical training. These are programmes designed specifically to close the gap between academic theory and what employers actually need.

Invest in Job-Ready Training

Think of targeted training as your career accelerator. Instead of just learning concepts, you will be gaining the exact software certifications and practical skills that hiring managers are looking for right now.

This is a smart move, especially because the demand for skilled professionals is on the rise. Recent figures show that 116,000 students were registered with Recognised Qualifying Bodies in the UK and ROI. This is a solid jump from the previous year. You can dive deeper into the FRC’s insights into the accountancy profession to see just how much the industry is growing.

To make the biggest impact, look for programmes that deliver tangible skills in these key areas:

- Bookkeeping & VAT: Get certified in software like Xero and Sage to handle the day-to-day finances of a business.

- Advanced Payroll: Master the complexities of payroll management—a non-negotiable skill for almost any company.

- Accounts Assistant & Final Accounts: Build the core competencies needed to support a finance team through the entire accounting cycle.

- Business & Data Analyst: Learn to use tools like Power BI and SQL to transform financial data into strategic business insights.

Build Your Professional Identity

Getting your first job is one thing; building a career is another. Beyond the qualifications, you need to actively shape your professional identity. It is about knowing how to create a personal brand that opens doors and positions you as a committed, forward-thinking professional.

This proactive approach shows top employers you are serious about your long-term growth. It shows you are invested in becoming a valuable member of their team.

Your qualifications get you on the longlist, but your practical skills and professional presence get you the job. Investing in job-focused training is the most effective way to demonstrate you are ready to contribute from your very first day.

Choosing the right training is not just a box-ticking exercise; it is your call to action. By investing in practical skills that fast-track your journey into accounting, you are not just looking for a job—you are building a foundation for a rewarding and successful career.

Got Questions About Getting into Accounting?

Breaking into a new field always comes with a lot of questions. To make things a little clearer, here are the answers to some of the most common queries we hear from aspiring accountants.

Do I Really Need a University Degree to Become an Accountant in the UK?

Absolutely not. While a university degree is a well-trodden path, it is far from the only one. Many employers now value practical, hands-on skills just as much, if not more, than a purely academic background.

Routes like an apprenticeship or a professional qualification like the AAT get you into the workplace faster. They teach you the real-world skills you will use every day. Targeted courses in bookkeeping, payroll, or data analysis are even more direct.

- The AAT qualification is a fantastic practical option that can be completed in around 18–24 months.

- Apprenticeships are a brilliant way to earn while you learn, blending on-the-job training with structured study.

- A university degree takes three years and can offer exemptions from some professional exams later on, but it is a longer, more theoretical route.

How Long Does It Take to Become Fully Qualified?

This really depends on the path you choose. If you go the university route, you are looking at a three-year degree. This is followed by around three years of professional training and work experience to become chartered with bodies like ACCA or CIMA. So, about six years in total.

But if you start with an apprenticeship, you could be qualified in three to five years, all while getting paid.

Even better, starting with a qualification like the AAT can get you into an accounting technician role in as little as 18 months. From there, you can continue your studies to become chartered while already established in your career.

Key Takeaway: There is no single “right” timeline. Your journey depends on whether you prefer to dive into practical work straight away or start with a deeper theoretical foundation.

What Skills Do I Actually Need for an Entry-Level Role?

These days, employers expect you to walk in the door with solid cloud accounting software skills. Getting comfortable with platforms like Xero or Sage is non-negotiable. You will also need to be a whiz with Excel. We are talking PivotTables, VLOOKUPs, and advanced formulas, not just basic spreadsheets.

To really stand out, get some data skills under your belt. A working knowledge of tools like Power BI or even basic SQL can put you miles ahead of other candidates. Imagine being able to build a Power BI dashboard to analyse company expenses and spot cost-saving trends in minutes. That is the kind of value employers are desperate for.

Can I Get into Accounting If I’m Not a Maths Genius?

Yes! This is one of the biggest myths out there. Modern accounting is far less about complex mental arithmetic. It is much more about logic, precision, and problem-solving. All the heavy-duty calculations are handled by software.

What is far more important is your ability to think critically and communicate clearly.

- Attention to detail is crucial for keeping records accurate and compliant.

- Logical thinking helps you make sense of financial information and spot irregularities.

- Good communication is essential for explaining financial reports to colleagues and clients who are not accountants.

Hopefully, these answers give you a clearer picture of what it takes to start your accounting journey.

If you are ready to get practical, our training courses are designed to give you the exact skills employers are looking for. We cover everything from bookkeeping and VAT to data analysis. This is complete with official certifications in Xero, Sage, and QuickBooks. Plus, we will help you nail your CV and interviews.

Why not explore our courses and find the pathway that is right for you?

Professional Careers Training provides 1-2-1 training with ACCA qualified Chartered Accountants, flexible timings, official certification and recruitment support to launch your UK accounting career. Visit https://professionalcareers-training.co.uk to get started.