So, you're thinking about becoming ACCA qualified. It’s a fantastic move. This isn't just another qualification; it's a globally recognised badge of expertise that shows...

Understanding The Rulebook Of Business Finance

Financial reporting standards provide a shared language. This common ground allows investors, lenders, and even the tax authorities to understand a company’s financial health with confidence.

Without them, every company could report its finances differently, making it impossible to gauge performance or make informed decisions. Imagine trying to compare measurements in metres, feet, and cubits all at once – it would be chaos.

This structured approach brings much-needed order to the complex world of accounting. For anyone starting a career in bookkeeping, accounts, or business analysis, mastering this language is a fundamental first step. Understanding the standards is not just about ticking compliance boxes; it’s about producing financial information that is genuinely trustworthy and useful. This is a core skill taught in courses covering everything from bookkeeping & VAT to final accounts preparation.

Why Do These Standards Matter So Much?

The importance of these standards becomes crystal clear when you look at their impact. They are the bedrock of financial integrity, ensuring that the numbers presented in a company’s accounts are a true and fair reflection of its activities.

This has several key benefits:

- Builds Trust: Standardised reports give stakeholders confidence that the information is accurate and reliable.

- Enables Comparison: It allows for a fair comparison between different companies, industries, or even accounting periods.

- Improves Decision-Making: Credible financial data helps management, investors, and lenders make better strategic choices.

At their core, these standards provide a framework for accountability. To ensure your financial disclosures are both accurate and effective, it’s vital to follow these 10 financial reporting best practices tailored for service businesses.

This guide will introduce you to the main frameworks in the UK and show how practical training in areas like accounts assistant roles and business analyst functions can turn these rules into career-defining skills.

Where Did UK Financial Reporting Rules Come From?

To really get a handle on today’s accounting standards, it helps to know the story behind them. The history of UK financial reporting is not just a dry timeline of dates; it’s a story of businesses scaling up, investors demanding clearer information, and the slow but steady realisation that a common financial language was vital for a healthy economy.

In the early days, company laws gave some basic guidance, but there was no unified rulebook. This chaos made it incredibly difficult for investors and lenders to compare one company’s performance against another, which created a lot of uncertainty and risk. It soon became obvious that a more structured approach was needed to build trust.

The Move Towards Standardisation

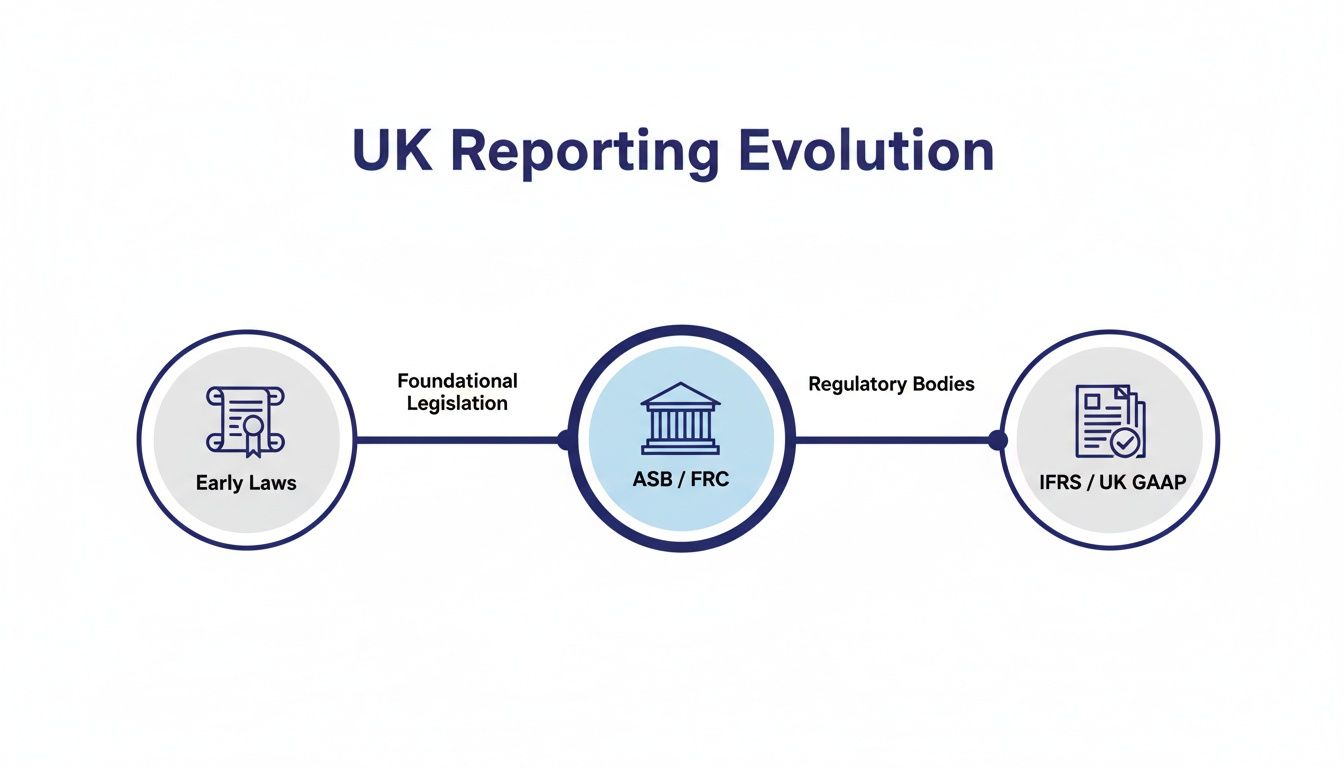

The journey to modern standards began as a direct response to this need for consistency. Early attempts laid the groundwork, but the real shift happened in 1990 with the creation of the Financial Reporting Council (FRC). The FRC, in turn, set up the Accounting Standards Board (ASB), which introduced the Financial Reporting Standards (FRS) that would shape UK accounting for decades.

This framework, known as UK GAAP, was the law of the land for most company accounts until 2005. That year was a huge turning point: all UK-listed companies—more than 2,000 of them—had to switch to International Financial Reporting Standards (IFRS) to align with EU rules. But for the vast majority of unlisted UK companies, a modernised UK GAAP came into force in 2015, with FRS 102 becoming the main standard. You can see a full timeline of these developments on the ICAEW website.

Getting to grips with this history is a game-changer for anyone starting out in finance. It explains the ‘why’ behind the rules you’ll be applying in roles from bookkeeping to business analysis, giving you a deeper professional insight that employers really value.

Why This History Matters For Your Career

Knowing how these rules evolved is not just for trivia nights. It shows you have a proper understanding of what financial reporting standards are and, more importantly, why they even exist. When you are preparing a set of final accounts or analysing a company’s performance, you are not just following a checklist; you are working with a system built over decades to create trust and clarity.

For instance, knowing the difference between IFRS and FRS 102 instantly tells you something about the company whose statements you’re looking at. This kind of knowledge is fundamental for practical training in roles like:

- Accounts Assistant, where you will be preparing accounts under a specific framework.

- Bookkeeping & VAT courses, because these principles dictate how every single transaction is recorded.

- Business Analyst training, where interpreting data correctly depends entirely on knowing the rules used to create it.

This historical context gives you a solid foundation, turning you from someone who just follows instructions into a professional who truly understands them.

Comparing IFRS And UK GAAP

When you get into the nitty-gritty of financial reporting standards in the UK, you will find the landscape is dominated by two main frameworks: IFRS and UK GAAP. Think of them as two different dialects of the same language, each spoken by different types of businesses. For anyone in an accounting or finance role, knowing which framework applies where is a fundamental first step.

This diagram shows just how far UK financial reporting has come, evolving from early laws to the sophisticated dual IFRS and UK GAAP frameworks we rely on today.

It’s a journey towards a more structured and transparent system, leading to the specialised standards that now support everyone from global corporations to local UK businesses.

Who Uses Which Standard?

The choice is not random; it all comes down to a company’s size and whether its shares are publicly traded.

-

International Financial Reporting Standards (IFRS) are mandatory for UK companies listed on a public stock exchange. These are your large, multinational corporations with investors and stakeholders dotted across the globe. IFRS gives them a single, globally recognised rulebook so their financial statements can be compared like-for-like, anywhere in the world.

-

UK Generally Accepted Accounting Practice (UK GAAP) is the framework used by most other companies in the UK. The cornerstone of modern UK GAAP is Financial Reporting Standard 102 (FRS 102). It is less complex than IFRS, making it a much better fit—and more cost-effective—for private companies, from medium-sized businesses right down to smaller enterprises.

This split ensures that the reporting burden matches the size and public interest in a company. For an aspiring accounts assistant, understanding this distinction is key to preparing year-end accounts correctly.

Spotting The Key Differences

While IFRS and FRS 102 are built on many of the same core principles, they have important differences in how they treat certain financial items. Whether you are in bookkeeping, payroll, or business analysis, being aware of these distinctions is vital for accurate reporting and interpretation. Grasping these nuances is just as important as knowing how to read balance sheets, because it gives you the story behind the numbers.

Here’s a quick look at some of the main differences you will come across.

Comparing IFRS and FRS 102 Key Differences

The table below breaks down a few key accounting areas, showing the different approaches taken by IFRS (for large, listed companies) and FRS 102 (for most private UK companies). While not an exhaustive list, it highlights some of the most common distinctions that finance professionals need to be aware of.

| Area of Accounting | IFRS Treatment (for Listed Companies) | FRS 102 Treatment (for most UK Companies) |

|---|---|---|

| Property Revaluation | Allows revaluation of property, plant, and equipment, with changes recognised in ‘other comprehensive income’. | Also allows revaluation, but the rules can be slightly less prescriptive in some areas compared to IFRS. |

| Revenue Recognition | Follows a detailed five-step model under IFRS 15, focusing on performance obligations in contracts with customers. | Provides principles-based guidance that is generally less complex than the IFRS 15 model. |

| Intangible Assets | Generally prohibits the revaluation of intangible assets (like brand value), with limited exceptions. | Allows the revaluation of intangible assets if an active market for them exists. |

| Financial Instruments | Has very complex and detailed requirements for classifying and measuring financial instruments (e.g., derivatives). | Offers a simpler approach, particularly for basic financial instruments like loans and trade receivables. |

These differences, though subtle, have a real impact on how a company’s performance and position are presented.

Simplified Standards For Smaller Businesses

It was quickly realised that even FRS 102 could be too demanding for the UK’s smallest companies. To solve this, a simplified standard was created: FRS 105, ‘The Financial Reporting Standard applicable to the Micro-entities Regime’.

FRS 105 is designed specifically for ‘micro-entities’—the smallest of businesses. It dramatically cuts down the disclosure requirements, making it much easier and cheaper for them to prepare their statutory accounts. This tiered system shows that financial reporting standards are not one-size-fits-all.

This practical approach ensures the rules are proportionate, helping small business owners stay compliant without facing a mountain of administrative work. For those training in bookkeeping and accounts, working with clients of different sizes means you will likely encounter both FRS 102 and FRS 105 in your daily tasks.

The Core Principles Behind The Rules

Dive beneath the detailed frameworks of IFRS and UK GAAP, and you will find a handful of powerful ideas holding everything together. These core principles are the very bedrock of trustworthy financial information, ensuring every report is not just a jumble of numbers but a reliable story of a company’s performance. For any aspiring finance professional, getting to grips with this logic is non-negotiable.

These concepts are the ‘why’ behind every calculation and disclosure. They turn abstract rules into practical tools you will use in every role, from bookkeeping right through to complex data analysis. Ultimately, they ensure financial statements are consistent, comparable, and, most importantly, actually useful.

Foundational Accounting Concepts

A few key assumptions underpin all financial reporting standards. Think of them as the ground rules that every accountant must follow to produce information that’s both meaningful and consistent.

One of the big ones is the going concern principle. This concept assumes a business will keep trading for the foreseeable future. It’s a bit like buying a gift card from a local shop; you hand over your money with the confidence that the shop will still be open next week to honour it. This simple assumption allows companies to record assets for their future value, not just their immediate scrap value.

Another critical idea is the accruals concept. This dictates that you recognise income and expenses when they are earned or incurred, not when the cash actually changes hands. For example, a consulting firm records revenue for a project completed in January, even if the client does not settle the invoice until March. This gives a far more honest picture of the company’s performance during that period.

Qualities Of Useful Financial Information

For financial statements to be worth the paper they are printed on, the information inside must have certain qualities. These are not just nice-to-haves; they are essential characteristics that make the data reliable enough for making real-world decisions.

The two primary qualities are:

- Relevance: The information has to be capable of making a difference to a user’s decisions. This is closely tied to the concept of materiality—an item is considered material if leaving it out or getting it wrong could influence someone’s economic choice.

- Faithful Representation: The numbers and descriptions must faithfully represent the economic reality they claim to show. In short, the information must be complete, neutral, and free from error.

These principles are not just academic. They directly influence how final accounts are prepared, how advanced payroll is managed, and how business analysts interpret performance data. They are the silent partners in every single financial transaction.

Understanding how these principles are applied in the real world is key. To see this in action, it is worth exploring specific topics like SaaS revenue recognition under ASC 606, which shows exactly how these big ideas translate into very specific industry rules. Getting to grips with these foundational concepts is what separates a number-cruncher from a true finance professional.

How Standards Shape Your Finance Career

Getting to grips with what financial reporting standards are is not just an academic box-ticking exercise; it is the key that unlocks genuine career opportunities. For roles like Accounts Assistant, Bookkeeper, or Financial Analyst, this knowledge is not a “nice-to-have”—it is the fundamental language of the job, underpinning every single task you will perform.

Employers are not just hoping you know about UK GAAP (especially FRS 102) and IFRS. They are actively looking for people who can navigate these frameworks with confidence. It’s what separates a good applicant from a successful new hire and builds the foundation for your climb into more senior roles.

From Theory to Your Daily To-Do List

Think about the day-to-day work of a finance professional. Whether you are preparing final accounts, wrestling with complex VAT returns, or running advanced payroll, every action is guided by these standards. They are the rulebook for how you recognise revenue, value assets, and classify liabilities.

Without a solid grasp of this rulebook, your work would lack the consistency and accuracy that businesses rely on to survive and grow. This is where theory stops being abstract and becomes a tangible, valuable skill.

- Bookkeeping & VAT: Standards dictate how you record transactions day-in, day-out, and how VAT is calculated and reported to keep HMRC happy.

- Advanced Payroll: Payroll is more than just paying staff. It involves accounting for pensions, benefits, and taxes according to strict reporting rules.

- Accounts Assistant: A massive part of your job will be helping to prepare financial statements, which must follow FRS 102 or other relevant standards to the letter.

- Final Accounts Preparation: This entire process is a direct, real-world application of financial reporting standards, from the first journal entry to the final signed-off report.

It is this direct link between the standards and your daily tasks that makes hands-on experience so valuable to employers.

Gaining the Edge with Practical Training

Reading about standards in a textbook is one thing. Actually applying them in a real-world context is what makes your CV stand out from the pile. This is where practical, mentored training becomes your secret weapon. Being able to use industry-standard software like Sage and Xero to apply these reporting standards is a powerful skill.

Imagine sitting in an interview and confidently explaining how you used FRS 102 to prepare a full set of management accounts for a case study company. That’s the kind of job-ready experience that gets you hired.

When you learn under the guidance of ACCA-qualified accountants, you are not just memorising rules. You are learning how to interpret and apply them in messy, real-world scenarios—the exact kind you will face on your first day. This experience builds not only your competence but your confidence, too. This is why focused courses in accounts assistant, bookkeeping, and final accounts training are so effective.

And if you are thinking about the next step after mastering these practical skills, our guide on how to become a chartered accountant in the UK can help you map out your long-term career path.

This hands-on approach closes the gap between the classroom and the office, turning your theoretical knowledge into a powerful toolkit for professional success. It proves to employers you can deliver accurate, compliant work from day one.

Your Questions On Financial Reporting Answered

Diving into financial reporting standards can feel a bit like learning a new language. It is natural to have questions, especially when you are just starting out. Here are some clear, straightforward answers to the queries we hear most often from new learners and people switching careers.

Why Are There Different Financial Reporting Standards?

Think of it this way: you would not use the same complex architectural blueprints to build a garden shed as you would for a skyscraper. Financial reporting standards work on a similar principle, with different rules designed for different types of companies.

-

IFRS (International Financial Reporting Standards) are the “skyscraper blueprints.” They are built for large, publicly listed companies whose shares are traded all over the world. These standards are naturally more complex and demand extensive disclosures to keep global investors fully informed.

-

UK GAAP (mainly FRS 102) is more like a standard house plan. It is tailored specifically for private UK companies, making it less of a burden and more cost-effective for small and medium-sized enterprises (SMEs).

Then you have even simpler versions like FRS 105, which is for the smallest ‘micro-entities’, cutting their reporting requirements right down. This tiered approach just makes sense—it ensures the rules are proportionate to a company’s size and the level of public interest in its finances.

How Can I Gain Practical Experience With These Standards?

Reading about standards is one thing, but actually applying them is where the real learning happens. The single best way to get that practical experience is through hands-on training that puts you in real-world accounting scenarios.

You should look for courses that weave the standards directly into practical exercises using industry-standard software like Xero, Sage, or QuickBooks. This kind of applied learning is what bridges that crucial gap between knowing the theory and being able to do the job. It is what gives you the confidence and skills that employers are desperately looking for.

The goal is to move beyond simply knowing what financial reporting standards are to demonstrating that you know how to apply them. Working on case studies—preparing VAT returns, processing payroll, and compiling final accounts—all under the watchful eye of ACCA-qualified accountants, builds that job-ready competence.

This approach is what turns abstract knowledge into a tangible, valuable skill set.

Do Business Or Data Analysts Need To Know These Standards?

Absolutely. It is a non-negotiable. While an accountant is the one who prepares the financial statements, a business or data analyst has to interpret them to offer any meaningful strategic advice. If you are going to analyse a company’s performance or forecast its future, you have to understand the rules that were used to create the data in the first place.

For instance, knowing how revenue is recognised under IFRS 15 or how assets are valued under FRS 102 is fundamental to an accurate analysis. Without that context, a business or data analyst could easily misinterpret the numbers, leading to flawed conclusions and poor business recommendations. Effective analysis depends entirely on knowing the story behind the numbers, making this knowledge a cornerstone of any high-quality business analyst or data analyst training programme.

Ready to turn your knowledge into a career? At Professional Careers Training, we provide hands-on, mentored training in bookkeeping, payroll, and business analysis, equipping you with the practical skills employers demand. Explore our courses and start building your future today.