Congratulations on completing your AAT Level 3 Diploma in Accounting! This significant achievement has equipped you with a robust set of skills, from advanced bookkeeping...

Understanding The Foundations Of Financial Accuracy

Think of it like a traditional balancing scale. Every time you place a weight (a transaction) on one side, you must add an identical weight to the other to keep it level. This simple principle is what gives businesses a complete and accurate picture of their financial health.

This system is far more than just a list of money coming in and going out. It’s a logical framework that shows exactly how money flows into, out of, and within a business. It’s built on the idea that for every action, there’s an equal and opposite reaction—and this is captured perfectly in the company’s accounts.

Why This Method Is A Non-Negotiable Skill

If you’re serious about a career in finance, understanding double-entry bookkeeping isn’t just helpful; it’s essential. It’s the language of business, crucial for everyone from an accounts assistant preparing final accounts to a business analyst or data analyst interpreting financial trends. Without a solid grasp of it, trying to interpret financial statements, manage advanced payroll, or handle bookkeeping & VAT becomes nearly impossible.

Mastering this system gives you several key advantages:

- Enhanced Accuracy: Because debits and credits must always match, the system has a built-in error checker. If the books don’t balance, you know instantly that a mistake has been made somewhere.

- A Complete Financial Picture: Unlike simpler methods that only track income and expenses, double-entry also tracks assets, liabilities, and owner’s equity. This gives you a holistic view of what a business owns versus what it owes.

- Improved Decision-Making: With accurate, reliable financial data, business leaders can make informed strategic decisions, whether that’s budgeting for a new project or securing a business loan.

This balanced approach is fundamental to creating reliable financial statements, including the Balance Sheet and the Profit and Loss Statement. These documents are vital for stakeholders, investors, and tax authorities like HMRC.

Ultimately, this structured method brings order and clarity to the often-chaotic world of business finance. It turns a long list of transactions into a powerful tool for analysis and growth. To dig deeper into the mechanics, you can explore a comprehensive guide to the double entry bookkeeping system.

Learning these skills through practical, hands-on training is the first step toward building a successful career. Whether your goal is to manage a company’s bookkeeping and VAT returns, handle advanced payroll, or analyse complex datasets as a data analyst, your journey begins here, by mastering this foundational accounting principle.

The Unbreakable Rules of Debits and Credits

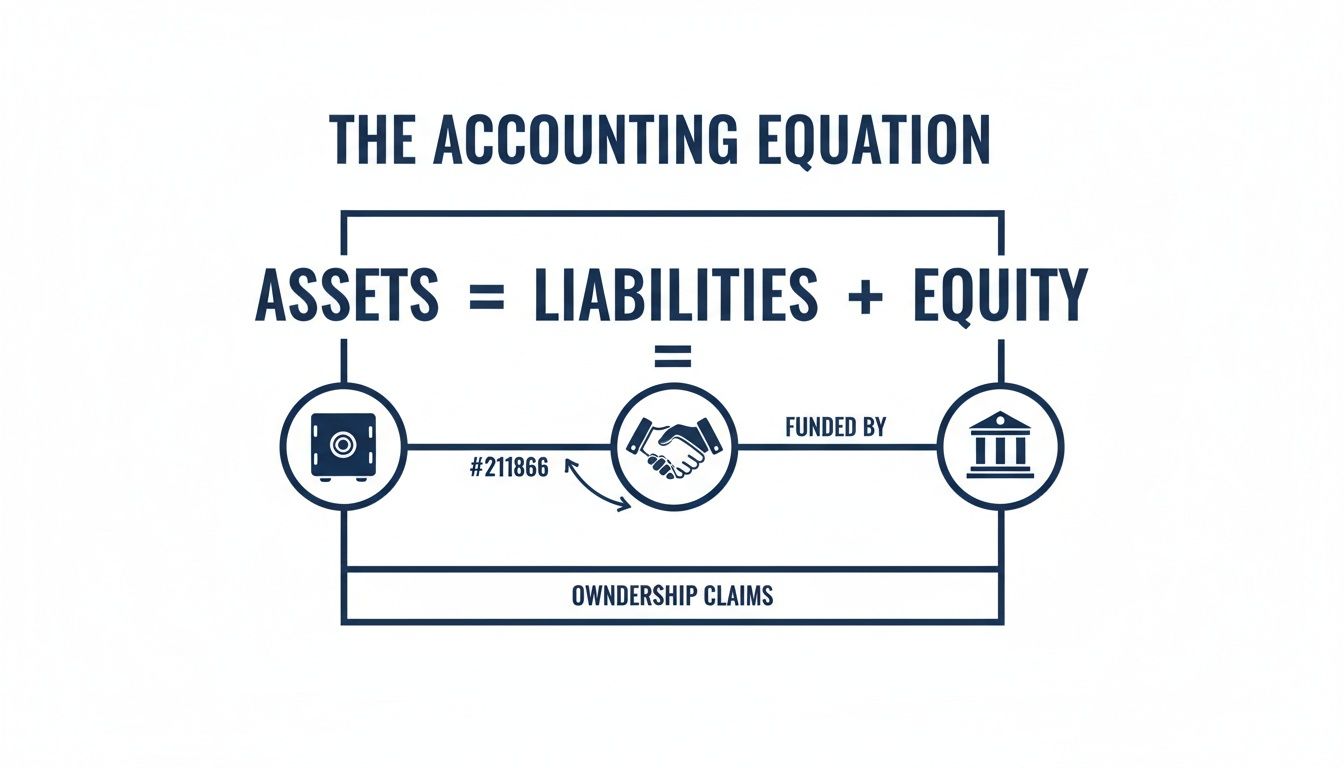

At the very heart of double entry bookkeeping lies a beautifully simple formula: the accounting equation. This isn’t just some dusty theory from a textbook; it’s the unbreakable logic that keeps a company’s financial records in perfect balance. Think of it as the engine powering the entire system.

The equation is surprisingly straightforward: Assets = Liabilities + Equity.

Let’s quickly break that down. Assets are everything your business owns that has value (like cash, equipment, or stock). Liabilities are what you owe to others (think bank loans or supplier invoices). And Equity is what’s left over for the owner—their stake in the business. Every single transaction, no matter how small, has to keep this equation perfectly balanced.

Understanding Debits and Credits

To keep the balance, every transaction is recorded using two entries: debits (Dr) and credits (Cr). It’s a common mistake to think of these as ‘good’ and ‘bad’ or ‘plus’ and ‘minus’. They’re not. Instead, they simply show the two sides of a transaction—where value has moved from and where it has moved to. A debit in one account always means a credit in another.

A good way to think about it is giving and receiving. If a business spends cash (an asset) to buy a new computer (another asset), it is ‘giving’ cash and ‘receiving’ a computer. Both sides of that exchange get recorded, making sure nothing ever gets missed. It’s this dual recording that makes double entry bookkeeping so robust and reliable for everything from preparing final accounts to managing VAT returns.

The golden rule is this: for every single transaction, the total value of the debits must precisely equal the total value of the credits. This is non-negotiable. It’s the system’s built-in error checker.

For instance, say a London-based graphic design studio buys a new computer for £1,500 using cash. The transaction is recorded in two accounts. The ‘Equipment’ account (an asset) goes up, while the ‘Cash’ account (also an asset) goes down. One account gets a debit, the other gets a credit, and the overall accounting equation stays perfectly in sync.

A Simple Mnemonic to Remember the Rules

Getting your head around which accounts increase with a debit and which with a credit can feel a bit tricky at first. This is where a brilliantly simple mnemonic called DEAD CLIC comes to the rescue. It’s an easy way to nail the rules and is a lifesaver for anyone starting out, especially in a role like an accounts assistant.

The mnemonic is broken into two halves:

- DEAD: Debits increase Expenses, Assets, and Drawings.

- CLIC: Credits increase Liabilities, Income, and Capital.

Let’s see how this works in a few common UK business scenarios.

Applying DEAD CLIC in Practice

Imagine you’re running a small business and need to log a few typical transactions. Using DEAD CLIC makes the whole process click into place.

First Scenario: You purchase inventory on credit for £500.

- Inventory is an Asset, so you Debit the Inventory account to increase it (that’s the ‘A’ in DEAD).

- You now owe your supplier money, which creates a Liability (Accounts Payable). You Credit the Accounts Payable account to increase it (the ‘L’ in CLIC).

Second Scenario: You make a cash sale to a customer for £200.

- Cash is an Asset, so you Debit your Cash account to show the increase (again, the ‘A’ in DEAD).

- The sale is Income, so you Credit the Sales Revenue account to increase it (the ‘I’ in CLIC).

Third Scenerio: You pay your monthly office rent of £1,000 from the bank.

- Rent is an Expense, so you Debit the Rent Expense account to increase it (the ‘E’ in DEAD).

- The money left your bank (an Asset), so you Credit the Cash/Bank account to show the decrease.

Notice how in every case, the debits equal the credits and the accounting equation remains balanced. This methodical process is exactly what accounting software like Sage, Xero, and QuickBooks automates behind the scenes, but truly understanding the logic is what separates a button-pusher from a pro. For anyone pursuing training in bookkeeping or advanced payroll, mastering these rules is the first and most critical step.

Applying Theory to Real-World UK Business Transactions

Understanding the theory of debits and credits is one thing, but applying it to real-world UK business scenarios is where you build genuine confidence. Let’s move beyond the abstract and walk through some common transactions, showing exactly how the double-entry system works in practice.

Getting this right is crucial for anyone stepping into a role like an accounts assistant or managing their own business finances. It’s the core skill that makes everything else click into place.

This simple diagram is the foundation of it all. It shows that what a business owns (Assets) must always equal what it owes to others (Liabilities) plus the owner’s stake (Equity). For every transaction, big or small, this equation must stay perfectly balanced.

Visualising Transactions With T-Accounts

One of the simplest and most powerful tools for visualising double-entry is the T-account. It gets its name from its ‘T’ shape, which neatly separates the debit (left side) from the credit (right side) for a single account.

By lining up two T-accounts side-by-side, we can clearly see the two-sided effect of any transaction. It’s a brilliant way to make sure nothing gets missed.

Let’s put this into practice with a few everyday examples.

Example 1: Making a Sale on Credit

Imagine your business, a marketing agency in Manchester, completes a project and issues an invoice for £2,000. The client hasn’t paid you yet, but you’ve earned the money.

- Accounts Affected: Accounts Receivable (an Asset, as it’s money owed to you) and Sales (Income).

- The Entries:

- Debit Accounts Receivable by £2,000 to show this asset has increased.

- Credit Sales by £2,000 to record the income you’ve earned.

- The Result: Your assets are up by £2,000, and so is your equity (via the increase in income). The equation is balanced.

A key takeaway here is that you recognise revenue when it’s earned, not just when the cash hits your bank. This is a fundamental concept for preparing final accounts and a core part of what you’ll learn in a bookkeeping & VAT training course.

Example 2: Purchasing Office Equipment

Your business buys new office chairs for £800 using the company debit card. The money comes straight from your bank account.

- Accounts Affected: Office Equipment (an Asset) and Bank (also an Asset).

- The Entries:

- Debit Office Equipment by £800 to increase this asset.

- Credit Bank by £800 to decrease that asset.

- The Result: The total value of your assets hasn’t actually changed. You’ve simply swapped one type of asset (cash) for another (equipment), keeping the equation perfectly balanced.

Example 3: Paying a Supplier Invoice

You receive an invoice from your web developer for £500 and pay it immediately from your bank account.

- Accounts Affected: Professional Fees (an Expense) and Bank (an Asset).

- The Entries:

- Debit Professional Fees by £500 to show the expense has increased.

- Credit Bank by £500 to show your cash asset has decreased.

- The Result: Your assets decrease by £500, and your equity also decreases by £500 because of the new expense. The balance holds firm.

Example 4: Receiving a Bank Loan

Your business secures a small business loan of £10,000. The cash is deposited directly into your business account.

- Accounts Affected: Bank (an Asset) and Bank Loan (a Liability).

- The Entries:

- Debit Bank by £10,000 to increase your cash balance.

- Credit Bank Loan by £10,000 to show you now have a new liability (a debt you must repay).

- The Result: Your assets have gone up by £10,000, and your liabilities have also increased by the exact same amount. Once again, perfect equilibrium.

These examples show how every single business action creates a ripple effect across at least two accounts. It’s a beautiful system when you get the hang of it.

Mastering these practical applications is the crucial first step towards proficiency. It builds the foundation you need for more advanced skills in payroll, business analysis, and even data analysis roles.

How Modern Accounting Software Automates Double Entry

Thankfully, the days of manually creating T-accounts and journal entries for every single transaction are long gone. Today, powerful accounting platforms like Sage, Xero, and QuickBooks are the standard for UK businesses, turning what was once a laborious process into a slick, automated workflow.

These platforms are built on the unbreakable rules of double-entry bookkeeping, but they cleverly hide the complex mechanics behind a user-friendly screen. When you record a single transaction, the software works instantly in the background to post the correct debits and credits, ensuring your books always balance.

The Engine Under the Bonnet

Think of your accounting software like the dashboard of a modern car. You don’t need to manually operate the engine’s pistons to get where you’re going, but a good driver understands what’s happening under the bonnet. The same logic applies here.

When you create a sales invoice in Xero, for example, you just fill in the customer’s details, the service you provided, and the amount. The software automatically handles the rest:

- It debits your Accounts Receivable account (an asset), showing money is now owed to you.

- It simultaneously credits your Sales Revenue account (income), recording what you’ve earned.

You only performed one action, but the software executed the double entry perfectly behind the scenes. This automation not only saves an incredible amount of time but also drastically reduces the risk of human error.

Even with this powerful automation, a deep understanding of what double-entry bookkeeping is separates a competent user from a true financial professional. When a report looks wrong, you need the underlying knowledge to diagnose the problem effectively.

Why Principles Still Outweigh Push-Button Processes

While software handles the “how,” it can’t tell you the “why.” Relying solely on automation without understanding the principles is like using a calculator without knowing basic arithmetic. You might get the right answer most of the time, but you’ll be lost the moment things go wrong.

A solid grasp of double-entry principles is essential for:

- Troubleshooting Errors: When bank reconciliations don’t match or a balance sheet looks odd, you need to know how to trace the debits and credits to find the source of the problem.

- Accurate Reporting: Understanding how transactions impact different accounts allows you to generate meaningful financial statements for tasks like preparing final accounts or managing advanced payroll.

- Strategic Decision-Making: Knowing the logic behind the numbers empowers business analysts and data analysts to interpret financial data correctly, turning reports into actionable business intelligence.

The enduring power of this system is deeply rooted in UK business history. Its legal entrenchment by the 1860s was a major shift driven by industrialisation, moving it from a niche method to the core of financial reporting. By ensuring debits equal credits, it provides the flawless balance sheet logic (Assets = Liabilities + Equity) that 98% of FTSE 100 firms rely on today.

From Manual Knowledge to Software Mastery

Mastering platforms like Sage, Xero, and QuickBooks is a non-negotiable skill for almost every finance role in the UK, from accounts assistants to business analysts. While these tools make the process faster, it’s your foundational knowledge that allows you to use them with precision and confidence.

Practical training bridges this gap, connecting timeless accounting rules with their modern digital application. By learning the principles first, you ensure you are in control of the software, not the other way around. To see how this works in practice, you can explore the top software tools we teach in our bookkeeping & VAT course. This combination of theoretical understanding and practical software skill is what makes a candidate truly job-ready.

Turning Your Knowledge into a Successful Career

Getting to grips with double entry bookkeeping is so much more than just an academic exercise. It’s a direct, powerful step toward building a rewarding career in the UK’s finance sector. This knowledge is like a universal key, unlocking doors to a huge range of industries and roles, whether you’re a recent graduate or looking for a career change.

When you understand this system, you stop being a passive observer and become an active participant in a business’s financial story. You learn the language to interpret a company’s health, spot potential problems, and even contribute to its strategic direction. It’s the bedrock on which successful careers are built.

But theory alone won’t get you hired. To really stand out in a competitive job market, you have to prove you can apply these principles using the tools that modern businesses depend on every single day.

Your Roadmap from Learning to Earning

A successful finance career is a journey, not a single leap. The most desirable candidates are those who follow a structured path, starting with a solid foundation and building specialised expertise on top.

Think of it like building a house. Double entry bookkeeping is the concrete foundation—everything else rests on it. From there, you add the essential pillars of practical, in-demand skills.

Here’s a clear, actionable roadmap for turning your understanding into a successful career:

- Start with the Essentials: Bookkeeping & VAT Training. This is your non-negotiable first step. A great course will give you hands-on experience, making sure you can handle day-to-day financial records, process VAT returns accurately, and understand HMRC compliance inside and out.

- Advance to Specialised Skills. Once your foundation is solid, you can start branching out into more specialised and higher-paying roles. This is where you can really shape your career path around what interests you.

- Advanced Payroll: Go beyond basic salary calculations to master complex payroll situations, pensions, and statutory payments. You’ll become an indispensable asset to any HR or finance team.

- Accounts Assistant & Final Accounts Preparation: Progress from daily bookkeeping tasks to helping prepare the year-end financial statements that are critical for business reporting and tax purposes.

- Business Analyst Roles: Use your financial know-how to analyse business processes, identify where things can be improved, and recommend data-driven solutions.

- Data Analyst Pathways: Combine your grasp of financial data with tools like SQL and Power BI to uncover powerful insights, forecast trends, and support big-picture strategic decisions.

The most effective training moves beyond theory, offering 1-to-1 support from ACCA-qualified accountants and CPD-approved trainers. This personalised guidance is invaluable for cementing your understanding and building real-world confidence.

The Importance of Practical Software Skills

In today’s business world, knowing your way around industry-standard accounting software is just as important as understanding the theory. Employers expect you to be ready for the job from day one, and that means being able to navigate platforms like Sage, Xero, and QuickBooks with confidence.

Any good training programme should provide official certification for these platforms. This certificate is a powerful signal to employers that you have the practical, verified skills needed to add value immediately. It’s a tangible asset on your CV that can set you apart from other applicants. For more insight, you can read our guide on how bookkeeping training can launch your career in finance.

Bridging the Gap to Your First Role

Gaining the right skills is only half the battle. The final step is navigating the job market, which can often be the most daunting part of the process—especially if you’re changing careers or new to the UK employment scene.

This is where comprehensive recruitment assistance becomes a game-changer. Look for training providers that offer a complete support system designed to get you hired.

This support should include:

- Professional CV Preparation: Crafting a CV that highlights your new skills and clearly communicates your value to employers.

- Interview Coaching: Practising interview techniques to build confidence and learn how to talk about your abilities effectively.

- Job Hunting Strategy: Getting expert advice on where to find the best opportunities and how to approach the application process.

- Employer Referrals: Gaining access to a network of recruitment partners who are actively looking for candidates with your exact skills.

Investing in your professional development is the most reliable way to secure your future. By following this structured path—from mastering double entry bookkeeping to gaining practical software skills and getting dedicated recruitment support—you aren’t just learning a subject. You’re actively building a successful and sustainable career.

Your Double Entry Questions, Answered

As you start to get your head around double entry bookkeeping, a few questions always come up. It’s one thing to understand the theory, but feeling confident enough to apply it is another matter entirely. Here, we’ll tackle some of the most common queries we hear from people starting their finance careers in the UK.

Think of this as the bridge between learning the rules and actually using them in a real business. Getting these fundamentals straight is what builds the foundation for a successful career.

Is Double Entry Bookkeeping a Legal Requirement in the UK?

This is a great, and very important, question. For almost every business in the UK, the answer is a practical yes. While the law doesn’t explicitly say “you must use double entry bookkeeping” for every single type of business, its principles are the only way to meet your legal and tax obligations properly.

All limited companies are legally required to file annual accounts that give a “true and fair view” of their financial position. It’s basically impossible to do this without a double entry system. It’s the only method that can produce the complete balance sheet and profit and loss statement that Companies House and HMRC require.

For sole traders and partnerships, the rules might seem a bit more relaxed. However, HMRC still demands records that are accurate and complete enough to work out their tax bill correctly. As soon as a business starts growing, dealing with VAT, or taking out loans, a double entry system becomes the only sensible way to manage the complexity. So, while it might not be a direct legal command for a one-person startup, it’s the professional standard and a practical necessity for accurate reporting.

What Is the Difference Between Single and Double Entry?

Understanding this difference really shines a light on the power of what is double entry bookkeeping. The main distinction is the completeness of the financial picture you get.

- Single-Entry Bookkeeping: This is the most basic way of keeping records, a bit like how you might track money in your personal bank account. It just records income and expenses in one long list. It’s simple, sure, but it’s also incomplete. It doesn’t track things like assets (equipment, vehicles) or liabilities (loans, credit card debt), which means you can’t produce a balance sheet or see the true financial health of the business.

- Double-Entry Bookkeeping: This system, as we’ve been exploring, records every transaction in at least two accounts with a matching debit and credit. This is what keeps the accounting equation in balance at all times. It tracks not just the cash flow but also the assets, liabilities, and equity, giving you a full, three-dimensional view of a company’s finances.

At its core, single entry is just a cash tracker. Double entry is a complete financial management system.

Can I Do Double Entry Bookkeeping Myself?

Absolutely. Many small business owners start out this way, especially with modern accounting software making it so much easier. Platforms like Xero, QuickBooks, and Sage automate a huge part of the process, a world away from the old days of manual ledgers.

But there’s a massive difference between doing the bookkeeping and doing it right. Without a proper grasp of the principles behind it, it’s incredibly easy to make mistakes that become expensive and time-consuming to unravel later. We often see things like miscategorised expenses, incorrect VAT entries, or accounts that just won’t reconcile.

While software is a fantastic tool, it’s not a replacement for knowledge. The system is only as good as the information you feed it. For anyone serious about a career in finance—whether as an accounts assistant or a business analyst—formal, hands-on training is the only way to build the confidence and competence that employers are looking for.

Investing in structured training means you don’t just learn how to use the software, but you understand the why behind every entry. That deeper knowledge is what lets you spot problems, generate accurate reports, and turn bookkeeping from a simple admin task into a powerful tool for business strategy.

Ready to turn your knowledge into a professional advantage? At Professional Careers Training, we provide the hands-on, expert-led courses you need to build a successful career in finance. From Bookkeeping & VAT to advanced payroll, final accounts, and data analysis, our 1-to-1 training with ACCA-qualified accountants will give you the job-ready skills and official software certifications employers are looking for.